The emergence of Digital Public Infrastructure like Account Aggregators (AA) paves the way for financial inclusion of many underserved communities in India. It has the potential to empower millions of customers to digitally access and share their financial data across institutions, resulting in the creation of their digital financial identity.

Account Aggregators make the lending process simpler, faster and more secure for SHGs.

AA reduces the existing know your customer (KYC) process of assessing loan applications from 3-4 days to 10-20 minutes.

AA builds a credit history and proof of creditworthiness by providing a digital record of financial transactions.

The process of AA ensures a smoother user journey, which results in lower drop-offs and reduced operating costs. 90% of people who used it went on to finish their loan applications.

Digital public goods such as AA have the potential to close the credit gap SHGs face today. This perspective uncovers the promise AA holds for SHGs in India and elaborates on two use cases that can be implemented on the ground to actualise AA-enabled digital financial inclusion.

(i) Loan disbursement through Loan Service Providers: AA shortens the existing Know Your Customer (KYC) process of assessing loan applications from 3-4 days to 10-20 minutes. With simple bank account linkages through OTP, AA enables real-time underwriting of SHG financial data for comprehensive credit assessment.

(ii) Loan monitoring to determine repayment abilities of SHGs: Recurring consent in AA enables the sharing of banking data to study SHG bank statements. This helps in analysing the financial health of SHGs during the loan tenure in order to establish an early detection system for defaulting borrowers.

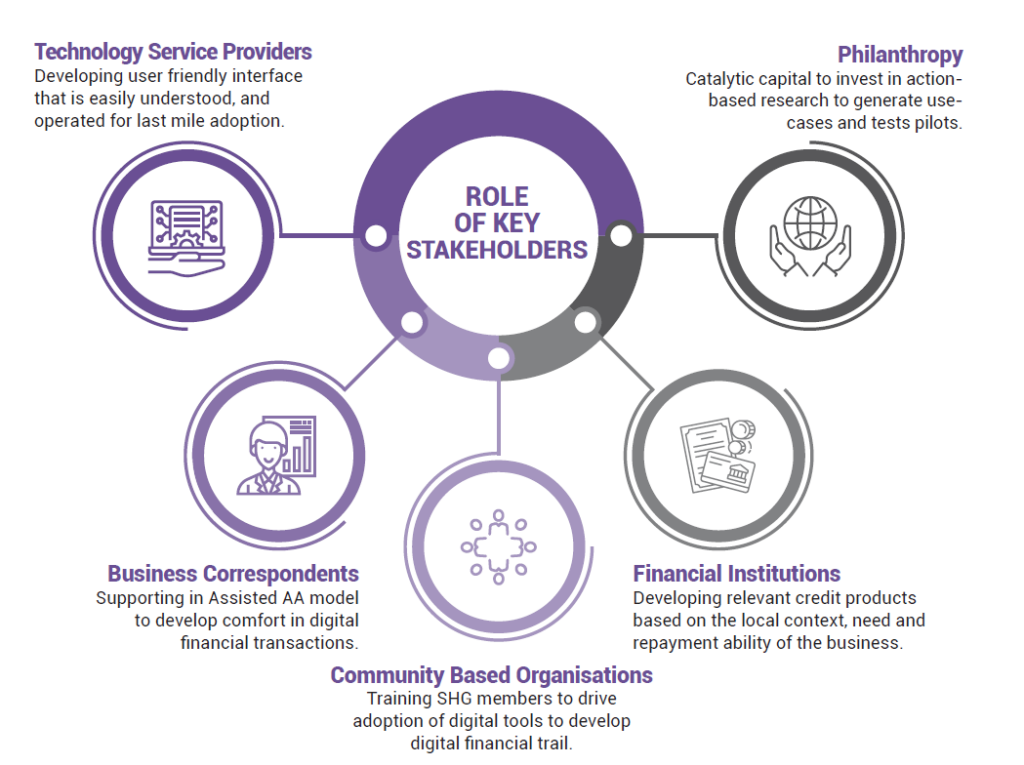

How can stakeholders create an enabling ecosystem for SHGs?

Philanthropy should demonstrate the applicability of the AA framework in small settings to highlight its potential. Last-mile financial inclusion requires suitable financial products. Lenders should prioritise the development of relevant financial products for underserved communities based on their business needs, context and repayment abilities.

Finally, the digital experience for last-mile applications needs to be strengthened. The technology service provider and AA companies should simplify the digital lending experience so that it is easily understood, trusted and operated by SHGs.

Click on the Download PDF button to access the detailed perspective.

Authors: Prerit Shukla, Asawari Luthra, Akshata Jain and Abhishek Yadav

We are grateful to the following contributors for their valuable insights into the scope of Account Aggregators in enabling financial inclusion of SHG women, which helped us shape this document:

- A Krishna Prasad, Founder & CEO, Onemoney

- Anjan Roy Choudhury, Director, Partnerships & Customer Success, Onemoney

- Arjun Singh, Former Managing Director, Asia, Envestnet Yodlee

- Arvind Kumar Malik, CEO, Udyogini

- Kanika Kumar, Director, IDEO

- Mallika Ghosh, Executive Director, Parinaam Foundation

- Mohammed Riaz, CEO & MD, Xtracap Fintech

- Monami Dasgupta, Head of Research, D91 Labs, Setu

- Nita Mahuvakar, CEO, Anarde Foundation

- Saibal Paul, Associate Director, Sa-Dhan

- Shailesh Dixit, Co-founder, Gromor Finance

- Vanita Shinde, Chief Administrative Officer, Mann Deshi Foundation

- Venkatram Jayanthy, CEO & MD, Indian Post Payments Bank

- Vikram Regunathan, Vice President, Samunnati Financial Services